Peer-to-Peer (P2P) Market (Type - NFC/Smartcard, SMS, and Mobile Apps; Application - Retail Payments, Travels & Hospitality Payments, Transportation & Logistics Payments, Energy & Utility Payments, and Others) Global Industry Analysis, Trends, Size, Share and Forecasts to 2027

A recent report published by Infinium Global Research

on the peer-to-peer (P2P) market provides an in-depth analysis of segments and

sub-segments in the global as well as regional peer-to-peer (P2P) market. The report is a comprehensive presentation of trends,

forecasts and dollar values of the global peer-to-peer (P2P) market. According to

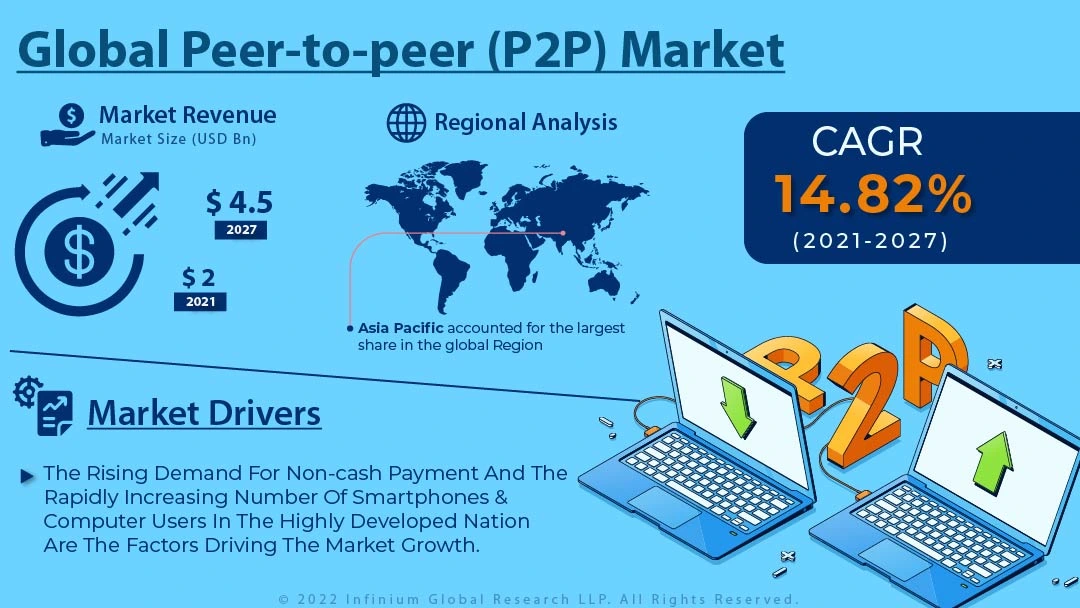

the report, the global peer-to-peer (P2P) market is projected to grow at a CAGR

of 14.82% over the forecast period of 2021-2027. The market growing from nearly

USD 2 billion in 2020 to about USD 4.5 billion in 2027.

Market Insight

Peer-to-peer payment systems are also known as P2P

payments or money transfer apps, like Venmo, PayPal, and Cash App allow their

users to send one another money from their mobile devices through a linked bank

account or card. Through this, we can also make splitting bills with friends

and family for dinner or house rent as such. They are trending amongst people

of all ages as more and more of these types of platforms continue to emerge in

the upcoming years. P2P services are secure platforms, but they’re also risks

involved while sending or receiving money online. Payments are categorized on

the basis of transfer that is to an account within the bank or outside the

bank. If the transfer is to an account within the bank it is called an internal

transfer. A transfer to an account outside the bank is called a domestic

transfer. The COVID-19 outbreak had

created medical emergencies across the globe. It created the biggest threats to

the global economy and financial markets. Major sectors of the country’s

economies, with manufacturing, auto, retail, aviation, and hospitality were

bearing the brunt of the lockdowns imposed by the government in order to

decrease the spread of disease. However, there were a few areas where we’re

seeing an uptick in digital payments by way of increased adoption during the

lockdown such as online grocery stores, online pharmacies, OTT players,

EdTechs, online gaming, recharges, and utility/bill payments. The demand for

easier ways to shop on mobile, receive stimulus checks, and make

donations to social causes, has significantly boosted the core segments of

digital payments, digital wallets, and peer-to-peer (P2P) payments across the

globe.

The fintech player combines the capabilities of the financial institutes and technology domain and develop an advanced customer-centric product to fulfill the requirement of the customers. Creating numerous opportunities for the development of the mobile peer-to-peer money transfer market across the globe. The Rising demand for non-cash payment and the rapidly increasing number of smartphones & computer users in the highly developed nation are the factors driving the market growth. Furthermore, privacy and data security concerns and a lack of awareness about P2P payment are hindering the market growth.

Among the regions, Asia Pacific accounted for the largest share in the global Peer-to-Peer Payment Market. This region has a large number of smartphone users and internet users in emerging economic nations such as China and India are boosting the market growth. 50% of smartphone users across the globe at present in the region as per the survey. The government in this region is initiating the promotion of digital payments and also creating awareness of the adoption of the mobile peer-to-peer money transfer market. However, the North American region is anticipated to grow with the highest rate in the global Peer-to-Peer Payment Market over the forecast period. The increasing use of payments in the industrial sector as well as the commercial sector is boosting the global P2P payment market in this region.

Segment Covered

The report on the global peer-to-peer (P2P) market covers

segments such as type, and application. On the basis of type, the sub-markets

include NFC/smartcard, SMS, and mobile apps. On the basis of application, the

sub-markets include retail payments, travels & hospitality payments,

transportation & logistics payments, energy & utility payments, and

others.

Companies Profiled:

The report provides profiles of the companies in the

market such as PayPal Pte. Ltd, Tencent, Square, Inc, Circle Internet Financial

Limited, clearXchange, SnapCash, Dwolla,Inc, TransferWise Ltd, CurrencyFair

LTD, and One97 Communications Ltd..

Report Highlights:

The report provides deep insights into demand

forecasts, market trends, and micro and macro indicators. In addition, this

report provides insights into the factors that are driving and restraining the

growth in this market. Moreover, The IGR-Growth Matrix analysis given in the

report brings an insight into the investment areas that existing or new market

players can consider. The report provides insights into the market using

analytical tools such as Porter's five forces analysis and DRO analysis of the peer-to-peer (P2P) market. Moreover, the study highlights current market trends

and provides forecasts from 2021-2027. We also have highlighted future trends in

the market that will affect the demand during the forecast period. Moreover,

the competitive analysis given in each regional market brings insight into

the market share of the leading players.

Please Choose One of them.