Natural Gas Refueling Infrastructure Market (Type - CNG Stations, and LPG Stations; Application - Large CNG Sub Station Vehicles, Natural Gas Vehicles (NGV), Ships, and Others; Ownership - Public, and Private): Global Industry Analysis, Trends, Size, Share and Forecasts to 2028

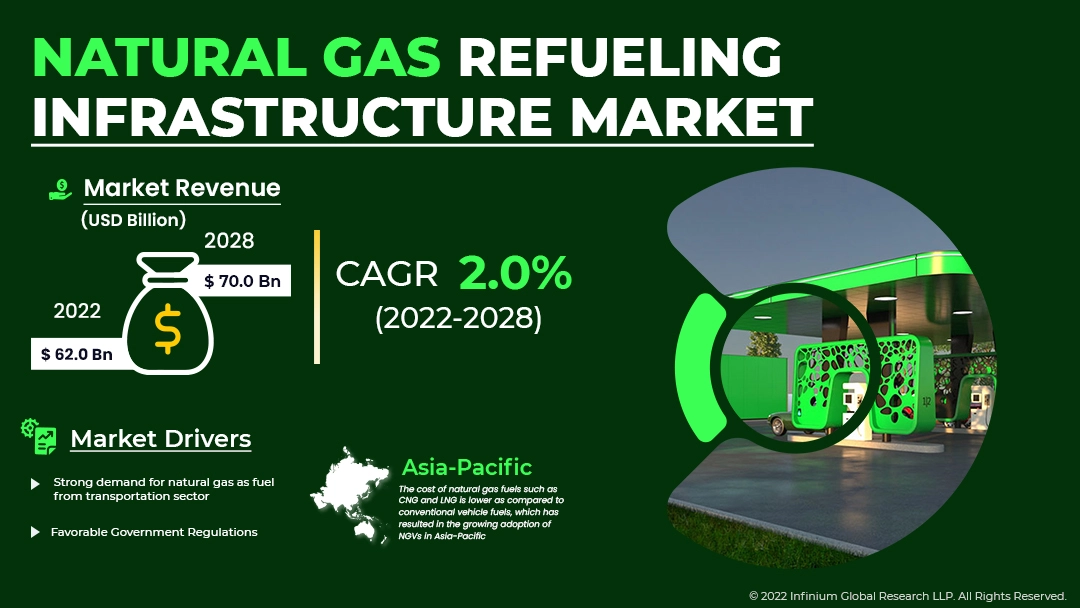

A recent report published by Infinium Global Research on the natural gas refueling infrastructure market provides in-depth analysis of segments and sub-segments in the global as well as regional natural gas refueling infrastructure market. The study also highlights the impact of drivers, restraints, and macro indicators on the global and regional natural gas refueling infrastructure market over the short term as well as long term. The report is a comprehensive presentation of trends, forecast and dollar values of the global natural gas refueling infrastructure market. According to the report, the global natural gas refueling infrastructure market is projected to grow at a CAGR of nearly 2% over the forecast period of 2022-2028.

Market Insight

The revenue generated by the natural gas refueling infrastructure market was over USD 62 billion in 2022 and is expected to reach about USD 70 billion in 2028 and is expected to grow with a CAGR of nearly 2% over the forecast period 2022-2028. Methane makes up the majority of the odorless, gaseous combination of hydrocarbons known as natural gas (CH4). Compressed natural gas (CNG) and liquefied natural gas are the two types of natural gas currently used in automobiles (LNG). Both products are readily available and reasonably priced. Stations for liquefied natural gas (LNG) and compressed natural gas (CNG) differ greatly. While LNG stations need less equipment but more safety measures when refueling, CNG stations need more configuration and equipment. Therefore, the natural gas refueling infrastructure can be classified into CNG stations and LNG stations. While designing and developing the natural gas refueling station, its, size and purpose of use play a vital role in what type of transportation the refueling station is required.

Rising fuel prices and environmental concerns related to the use of conventional fuels have led to the growth of natural gas as fuel in transportation. Thus, this has created a strong demand for natural gas for use as fuel in transportation. According to NGV Global, there were 28.5 million vehicles running on natural gas and around 33,383 natural gas fueling stations around the world in 2019. It is expected that the number of natural gas vehicles is expected to grow at an increasing rate creating the need for more refueling stations. Thus, this factor is majorly driving the growth of the market. The government rules and regulations are also favorable for developing natural gas refueling infrastructure. The approvals required for creating the infrastructure for natural gas refueling are being made easier to obtain and also incentives are being provided to some extent. But the growing number of EV vehicles may hamper the growth of the market. However, technological advancements in refueling technology are expected to boost growth opportunities in the market.

The largest documented demand shock in the history of natural gas occurred in 2020 on the global market. Due to unusually mild temperatures during the first few months of the year, the Covid-19 pandemic affected a gas demand that was already on the decline. Natural gas markets saw a significant supply and trade adjustment due to this unexpected shock, which led to historically low spot prices and extreme volatility. The flow of traffic running on natural gas declined sharply which severely impacted the demand for natural gas. Thus with no demand for natural gas the development of natural gas refueling infrastructure was also jolted. Most of the projects were postponed due to the low availability of manpower, equipment, and components. The recovery of the market was on a much faster rate as the covid-19 started subsiding.

The global natural gas refueling infrastructure market is segmented into North America, Asia-Pacific, Europe, and the RoW region. Regarding revenue, Asia-Pacific is expected to be the dominant region in the market. The sale of NGV or natural gas vehicles in developing countries such as India and China is proliferating. These countries are focusing on lowering their carbon emissions and trying to tackle the growing fuel prices. The cost of natural gas fuels such as CNG and LNG is lower as compared to conventional vehicle fuels, which has resulted in the growing adoption of NGVs in Asia-Pacific. According to there were 20,473,673 NGVs in Asia-Pacific in 2019 and about 20,275 NGV fueling stations. Above 60% of NGV vehicles and fueling stations are located in Asia-Pacific. Thus, the widespread adoption of NGVs has been instrumental in the strong growth of the market in Asia-Pacific.

Segment Covered

The report on the global natural gas

refueling infrastructure market covers segments such as type, application, and

ownership. On the basis of type, the sub-markets include CNG stations, and LPG

stations. On the basis of application, the sub-markets include large CNG sub

station vehicles, natural gas vehicles (NGV), ships, and others. On the basis

of ownership, the sub-markets include public, and private.

Companies Profiled:

The report provides profiles of

the companies in the market such as Linde plc, Blu LNG, Apache Corporation,

PETRONAS, ENN Energy Holdings Limited, Fuel System Solutions, Inc., General

Electric Company, GNC, Hygen Group, and Swagelok Company.

Report Highlights:

The report provides deep insights

into demand forecasts, market trends, and micro and macro indicators. In

addition, this report provides insights into the factors that are driving and

restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis

given in the report brings insight into the investment areas that existing

or new market players can consider. The report provides insights into the

market using analytical tools such as Porter's five forces analysis and DRO

analysis of the natural gas refueling infrastructure market. Moreover, the study

highlights current market trends and provides forecast from 2022-2028. We also

have highlighted future trends in the market that will affect the demand during

the forecast period. Moreover, the competitive analysis given in each regional

market brings insight into the market share of the leading players.