Insurtech Market (Type - Auto, Business, Health, Home, Specialty, Travel, and Others; Service - Consulting, Support & Maintenance, and Managed Services; Technology - Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others; End-use - Automotive, BFSI, Government, Healthcare, Retail, Transportation, and Others): Global Industry Analysis, Trends, Size, Share and Forecasts to 2026

A recent report published by Infinium Global Research on insurtech market provides an in-depth analysis of segments and sub-segments in the global as well as regional insurtech market. The study also highlights the impact of drivers, restraints, and macro indicators on the global and regional insurtech market over the short term as well as long term. The report is a comprehensive presentation of trends, forecast, and dollar values of the global insurtech market. According to the report, the global insurtech market is projected to grow at a CAGR of 38.12% over the forecast period of 2020-2026.

Market Insight

The global insurtech market size was valued around USD 2 billion in 2019 and is anticipated to grow at a CAGR of 38.12% during the forecast period. Insurtech is a collective term that is utilized for companies that use innovative technologies such as artificial intelligence, big data, and the internet of things, among others to enhance their functioning and upsurge customer engagement. Unlike, traditional insurers, insurtech driven insurers are investing in digitization in order to cut down costs on the part of agents and directly provide insurance policies to the consumers. Furthermore, an online presence can now be used for assisting customers 24x7, which was impossible previously. Insurance companies are adopting digital technologies to simplify financial transactions and improve the functionality of the payment procedure. Moreover, the adoption of insurtech among insurance companies helps them to identify risks associated with the business operation, market, liquidity, counterparty, and credit.

Growing demand for data analysis and AI-based solutions among insurance companies to expand their business internationally by offering services on a digital platform is anticipated to drive the growth of the market. Furthermore, increasing awareness of insurtech and digitalization among insurance companies and agencies to improve the insurance services is also projected to propel the growth of the market. Also, simplification of the claims processes is expected to drive growth in the near future. The rising adoption of insurtech with advanced technologies such as machine learning, artificial intelligence, and blockchain technology is estimated to generate revenue opportunities for solution providers during the projection period. However, increasing security threats by cyber-attacks and a dearth of skilled professionals expected to hamper the growth of the insurtech market.

Among the geographies, the North American region is expected to hold the largest share in the global insurtech market. The industry is expected to offer huge opportunities for insurtech market growth on account of the presence of numerous key players. Also, the region has a strong base of technology which boosts the market growth. The North American region is witnessing an augmented adoption of insurtech solutions due to increased spending of customers in the area of insurance-related products. Furthermore, the Asia Pacific region is anticipated to witness high growth in the insurtech market during the forecast period. The inclination towards advanced technology such as Artificial Intelligence, machine learning, etc. and increasing investment in insurtech solution by companies in this region which leads to boost the market growth during the projection period.

Segment Covered

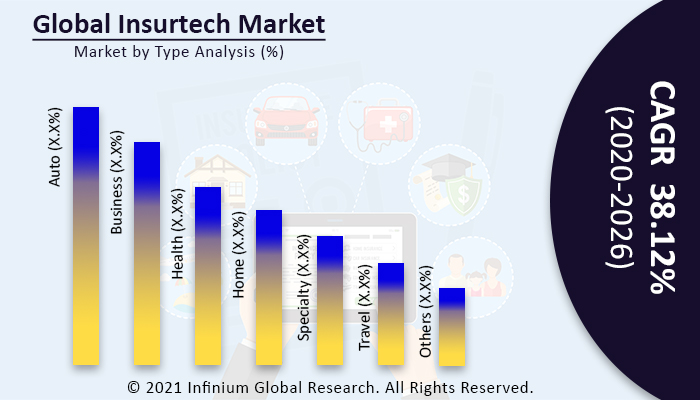

The report on the global insurtech market covers segments such as type, service, technology, and end-use. On the basis of type, the sub-markets include auto, business, health, home, specialty, travel, and others. On the basis of service, the sub-markets include consulting, support & maintenance, and managed services. On the basis of technology, the sub-markets include blockchain, cloud computing, IoT, machine learning, robo advisory, and others. On the basis of end-use, the sub-markets include automotive, BFSI, government, healthcare, retail, transportation, and others.

Companies Profiled:

The report provides profiles of the companies in the market such as Damco Group, DXC Technology Company, Insurance Technology Services, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, and Zhongan Insurance.

Report Highlights:

The report provides deep insights into the demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of insurtech market. Moreover, the study highlights current market trends and provides forecast from 2020-2026. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.

Please Choose One of them.