Identity Theft Insurance Market (Type - Financial Identity Theft, Medical Identity Theft, Employment Identity Theft, Tax Identity Theft, Child Identity Theft, Synthetic Identity Theft, and Others; Application - Enterprise, and Consumer): Global Industry Analysis, Trends, Size, Share and Forecasts to 2027

A recent report published by Infinium

Global Research on the identity theft insurance market provides in-depth analysis

of segments and sub-segments in the global as well as regional identity theft

insurance market. The study also highlights the impact of drivers, restraints,

and macro indicators on the global and regional identity theft insurance market

over the short term as well as long term. The report is a comprehensive

presentation of trends, forecast and dollar values of the global identity theft

insurance market. According to the report, the global identity theft insurance

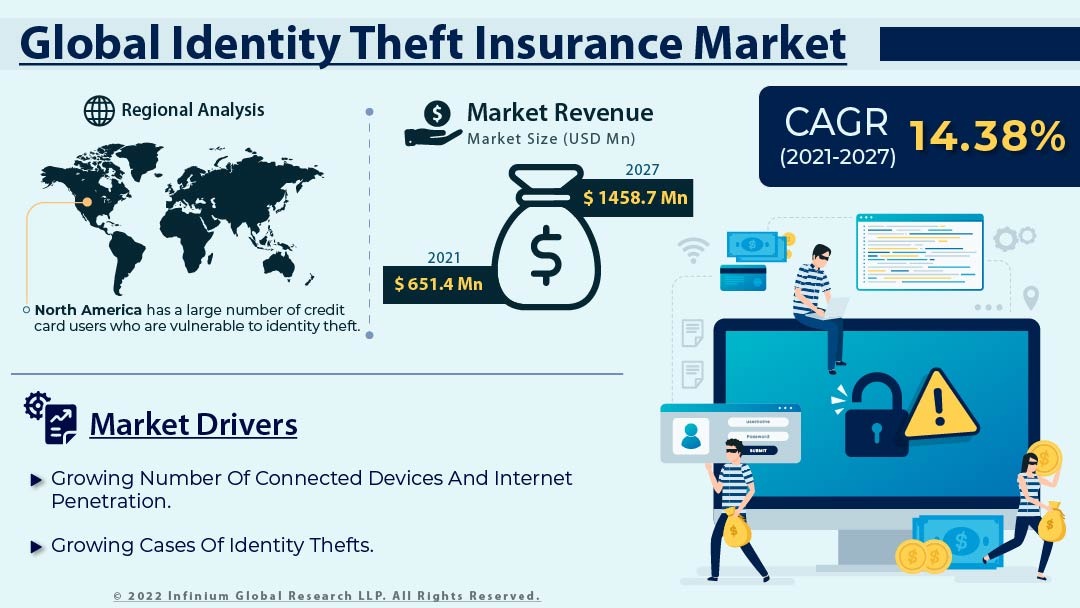

market is projected to grow at a CAGR of 14.38% over the forecast period of

2021-2027.

Market Insight

The revenue generated by the market was

approximately USD 651.4 million in 2021 and is expected to reach approximately

USD 1458.7 million in 2027. When someone acquires a person's personal

information, such as their Social Security number, and uses it to open a new

account, make a purchase, or commit other sorts of fraud, this is known as

identity theft. Because of the nature of technology and the internet, personal

information is always at risk. If a person does not maintain a tight eye on his

or her credit record, he or she may not realize that they have been injured

until it is too late. There are a number of causes that may lead to identity

theft, such as data breaches, insecure browsing, malware activity, credit card

theft, mail theft, phishing and spam attacks, Wi-Fi hacking, mobile phone

theft, card skimming, and others. Identity theft can result in immediate

financial loss, harm to a person's credit, and mental distress, depending on

the sort of theft that occurs and how the thief uses a person's information.

Internet penetration is growing rapidly

around the world, especially in developing countries. Growing internet

penetration has led to an increase in the adoption of connected devices such as

laptops, smartphones, tablets, and others. People use these linked devices for

financial transactions, employment purposes, tax returns, and other purposes.

The number of people who use online credit cards has increased dramatically.

These connected devices are vulnerable to cybercrimes, such as identity theft.

Thus, consumers have felt the need to have identity theft insurance that may

compensate them and provide relief in the event of identity theft. Therefore,

this factor is propelling the growth of the market. Also, identity theft cases

are growing rapidly around the world. According to the FTC, there were

1,387,615 reported identity thefts in the US in 2020. The rapid growth in the

number of identity theft cases has increased the awareness of the need for

identity theft insurance. Therefore, this factor has greatly boosted the demand

in the market. The growth of the market may be restrained as identity insurance

is highly expensive. Nevertheless, new growth opportunities are in foresight as

digitalization is growing in developing countries.

North America has a large number of credit

card users who are vulnerable to identity theft. This one factor has majorly

driven the market in North America. Also, subsequent data shows a sharp rise in

identity theft cases in the past few years. The Federal Trade Commission, also known

as the FTC, has revealed that there were 1,387,615 identity thefts in 2020, up

from 650,523 in 2019. The identity cases tripled in a span of just one year.

Furthermore, government documents or benefits fraud cases were 406,375, credit

card fraud cases were 393,207, employment or tax-related fraud cases were

113,529, and other identity theft cases were 353,152 in 2020 in the United

States. The immediate need for identity theft insurance can be understood based

on the statistics presented by the FTC. Thus, due to such huge market potential,

North America tops the market. Asia-Pacific is expected to grow at the fastest

rate as digitalization is going on in full swing and cyber threats such as

identity theft are rising.

Segment Covered

The report on the global identity theft

insurance market covers segments such as type, and application. On the basis of

type, the sub-markets include financial identity theft, medical identity theft,

employment identity theft, tax identity theft, child identity theft, synthetic

identity theft, and others. On the basis of application, the sub-markets

include enterprise and consumer.

Companies Profiled:

The report provides profiles of the

companies in the market such as Experian Information Solutions, Inc.,

IdentityForce, Inc., Aura Company, Trilegiant Corporation, NortonLifeLock Inc.,

Allstate Insurance Company, Zander Insurance Group, McAfee, LLC, Equifax, Inc.,

and TransUnion, LLC.

Report Highlights:

The report provides deep insights into the

demand forecasts, market trends, and micro and macro indicators. In addition,

this report provides insights into the factors that are driving and restraining

the growth in this market. Moreover, The IGR-Growth Matrix analysis given in

the report brings an insight into the investment areas that existing or new

market players can consider. The report provides insights into the market using

analytical tools such as Porter's five forces analysis and DRO analysis of the identity theft insurance market. Moreover, the study highlights current market

trends and provides forecast from 2021-2027. We also have highlighted future

trends in the market that will affect the demand during the forecast period.

Moreover, the competitive analysis given in each regional market brings an

insight into the market share of the leading players.

Please Choose One of them.