Contactless Payment Market (Device - Smartphones and Wearables, Point-of-sales Terminals, and Smart Cards; Solution - Payment Terminal Solution, Transaction Management, Security and Fraud Management, Hosted Point-of-sales, and Analytics; Application - Retail, Transportation, Healthcare, Hospitality, and Government): Global Industry Analysis, Trends, Size, Share and Forecasts to 2026

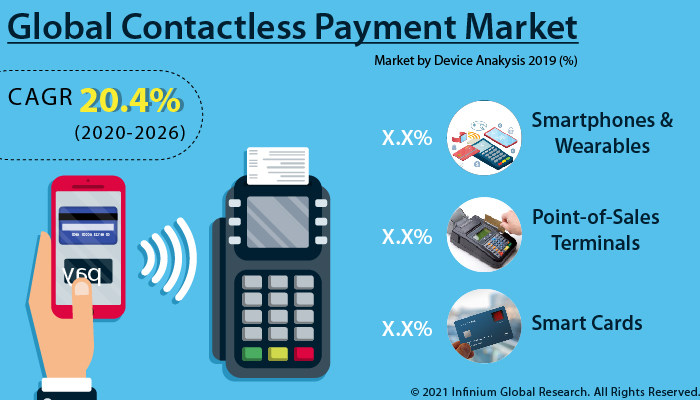

A recent report published by Infinium Global Research on the contactless payment market provides an in-depth analysis of segments and sub-segments in the global as well as regional contactless payment market. The study also highlights the impact of drivers, restraints, and macro indicators on the global and regional contactless payment market over the short term as well as long term. The report is a comprehensive presentation of trends, forecast, and dollar values of the global contactless payment market. According to the report, the global contactless payment market is projected to grow at a CAGR of 20.4% from nearly USD 1.4 trillion in 2020 up to USD 4 trillion in 2026 during the forecast period of 2020 – 2026.

Market Insight

Contactless payment is the protected process for the transaction of payments over credit cards, debit cards, key fobs, smartphones, and several others. The contactless payments are served under propinquity areas. Further, the embedded technology is utilized in the enactment of the integrated circuit chip and antenna to deliver contactless payment mode. This action itself, without the input of a PIN, will be sufficient to be able to complete the transaction. There are numerous advantages of using such a system as contactless payment, this system is easy to use, enormously convenient, especially in comparison to traditional payment methods as well as upsurges the overall efficiency in the payment method.

The growth of the contactless payment market is accredited to the rapid & secured transactions, real-time transaction processing, and reduces the time for executing payments, and other advantages provided by the contactless payment option. Furthermore, growing demand for mobile & wearable payment devices and growth in adoption of technology by merchants for small value transactions boost the market growth. Moreover, emerging economies provide momentous opportunities for contactless payment solution providers to expand & develop their offerings, particularly among emerging countries such as Australia, China, India, Singapore, and South Korea. Also, the integration of the Internet of Things (IoT) with a current contactless payment terminal is anticipated to provide profitable opportunities during the projection period. On the other hand, augmented rules & regulations imposed by banks toward payment are some of the factors that hinder the contactless payment market growth.

Additionally, the current concern over the spread of coronavirus is also expected to have a positive impact on the contactless payment market. The physical payment will be far less appropriate in the wake of the COVID-19 outburst; digital customer experience will be a foremost area of differentiation and competition for financial institutions. Furthermore, the COVID-19 epidemic is likely to spur a widespread and systematic refurbishing of high-impact digital journeys in the payment segment, such as customer onboarding and product origination, to deliver a truly outstanding digital experience to their clientele. Another key factor likely to accelerate is the transformation of contactless payment from servicing to engagement. Once the COVID-19 epidemic halts, clienteles will have been familiar to spend considerably less time in branches. This means that banks will require selling more products through digital channels to compensate for the reduction in sales assimilated through branches.

Among the geographies, the European region is expected to hold the largest share in the global contactless payment market as countries such as the UK, Germany, and France are the front-runners of the adoption of new technology in the payment sector. These nations have a major dominance, with sustainable and well-established economies, which allow them to intensely invest in R&D activities, thereby contributing to the development of innovative technologies in the contactless payment market. However, with the growing adoption of advanced payment technology is improving security, especially in the BFSI sector; several organizations are adopting contactless payment solutions. This factor is propelling the contactless payment market growth in the Asia Pacific region.

Segment Covered

The report on the global contactless payment market covers segments such as device, solution, and application. On the basis of device, the sub-markets include smartphones and wearables, point-of-sales terminals, and smart cards. On the basis of solution, the sub-markets include payment terminal solution, transaction management, security and fraud management, hosted point-of-sales, and analytics. On the basis of application, the sub-markets include retail, transportation, healthcare, hospitality, and government.

Companies Profiled:

The report provides profiles of the companies in the market such as Gemalto N.V., Verifone Systems Inc., Ingenico Group SA, Visa Inc., Giesecke&Devrient GmbH, Heartland Payment Systems, On Track Innovations (OTI) Ltd, Thales Group, Wirecard AG, and Oberthur Technologies Morpho.

Report Highlights:

The report provides deep insights into the demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of the contactless payment market. Moreover, the study highlights current market trends and provides forecast from 2020-2026. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.

Please Choose One of them.