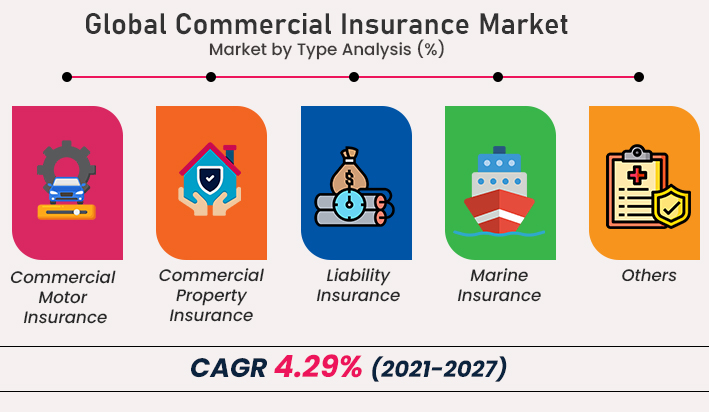

Commercial Insurance Market (Type - Commercial Motor Insurance, Commercial Property Insurance, Liability Insurance, Marine Insurance, and Others; Distribution Channel - Agents & Brokers, Direct Response, and Others; Enterprise Size - Large Enterprises, and SMEs; Industry Vertical - Construction, IT & Telecom, Healthcare, Energy & Utilities, Transportation & Logistics, and Others): Global Industry Analysis, Trends, Size, Share and Forecasts to 2027

A

recent report published by Infinium Global Research on the commercial insurance

market provides an in-depth analysis of segments and sub-segments in the global as

well as regional commercial insurance market. The study also highlights the

impact of drivers, restraints, and macro indicators on the global and regional

commercial insurance market over the short term as well as long term. The

report is a comprehensive presentation of trends, forecast and dollar values of the global commercial insurance market. According to the report, the global

commercial insurance market is projected to grow at a CAGR of 4.29% over the

forecast period of 2021-2027.

Market Insight

The

commercial insurance market was valued at USD 825.2 billion in 2020 and is

expected to reach USD 1088.9 billion in 2027, growing with a CAGR of 4.29%

during the forecast period. Commercial insurance is a type of insurance that

offers insurance to large, small, and medium enterprises and protects them from

unwanted risks. Furthermore, this commercial insurance might comprise property

damages, a decrease in income owing to other businesses, robbery, legal issues,

and employee objections. It also delivers solutions to provide safety to

business operations at the time of necessity. In addition, commercial insurance

provides coverage for different industrial sectors such as manufacturing, IT

& telecom, logistics, retail, construction, healthcare, and many others.

An

increase in the demand for commercial insurance policies among small and

medium-sized enterprises is projected to drive the growth of the market during

the forecast period. Furthermore, owing to the significant effect of the

COVID-19 outbreak on business firms, the need for insurance policies has

augmented gradually and has become an essential factor for heightening the global

commercial insurance market. Moreover, owing to a large number of commercial

insurance providers, the market is anticipated to have a positive impact during

the projection timeframe. With such a maximum number of insurance companies to

choose from, there is ferocious rivalry among them to offer a wide range of

coverage for businesses of all kinds. However, the high commercial insurance

premiums and a dearth of commercial insurance knowledge among small businesses

are two factors hindering market growth.

Among

the geographies, the North American region is expected to hold the largest

share in the global commercial insurance market owing to the growing industries

across the region. The United States and Canada are anticipated to be the major

revenue contributors in the North American commercial insurance market.

Furthermore, the Asia Pacific region is projected to grow at the fastest rate

in the global commercial insurance market during the projection period, owing

to its growing industrialization across the region. Rapid economic

developments, globalization, digitalization, and the increased adoption of

technologies are anticipated to drive the commercial insurance market in the

Asia Pacific region.

Segment Covered

The

report on the global commercial insurance market covers segments such as type,

distribution channel, enterprise size, and industry vertical. On the basis of

type, the sub-markets include commercial motor insurance, commercial property

insurance, liability insurance, marine insurance, and others. On the basis of

distribution channel, the sub-markets include agents & brokers, direct

response, and others. On the basis of enterprise size, the sub-markets include

large enterprises, and smes. On the basis of industry vertical, the sub-markets

include construction, IT & telecom, healthcare, energy & utilities,

transportation & logistics, and others.

Companies Profiled:

The

report provides profiles of the companies in the market such as Allianz,

American International Group, Inc., Aon plc, Aviva, AXA, Chubb, Direct Line

Insurance Group plc, Marsh, Willis Towers Watson, and Zurich.

Report Highlights:

The

report provides deep insights into the demand forecasts, market trends, and

micro and macro indicators. In addition, this report provides insights into the

factors that are driving and restraining the growth in this market. Moreover,

The IGR-Growth Matrix analysis given in the report brings an insight into the

investment areas that existing or new market players can consider. The report

provides insights into the market using analytical tools such as Porter's five

forces analysis and DRO analysis of the commercial insurance market. Moreover, the

study highlights current market trends and provides forecast from 2021-2027. We

also have highlighted future trends in the market that will affect the demand

during the forecast period. Moreover, the competitive analysis given in each regional

market brings an insight into the market share of the leading players.

Please Choose One of them.