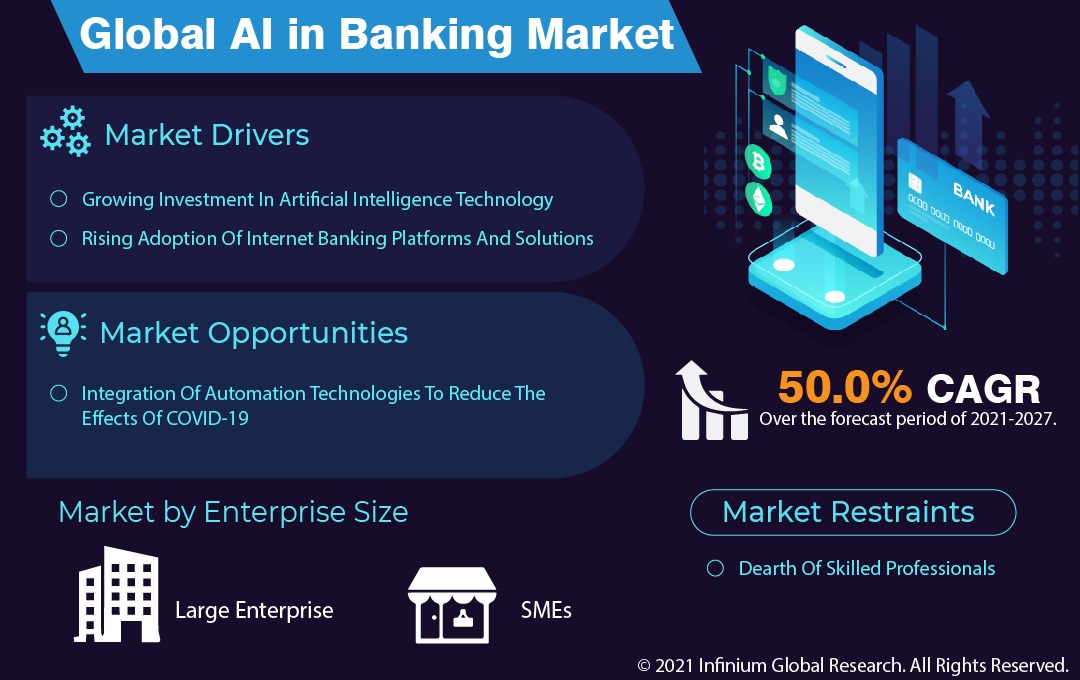

AI in Banking Market (Component - Solution, and Services; Technology - Machine Learning & Deep Learning, Natural Language Processing (NLP), Computer Vision, and Others; Enterprise Size - Large Enterprise, and SMEs; Application - Risk Management Compliance & Security, Customer Service, Back Office/ Operations, Financial Advisory, and Others): Global Industry Analysis, Trends, Size, Share and Forecasts to 2027

A recent report published by

Infinium Global Research on AI in banking market provides in-depth analysis of

segments and sub-segments in the global as well as regional AI in Banking

Market. The study also highlights the impact of drivers, restraints, and macro

indicators on the global and regional AI in in banking market over the short term

as well as long term. The report is a comprehensive presentation of trends,

forecast and dollar values of global AI in banking market. According to the

report, the global AI in banking market is projected to grow at a CAGR of 50%

over the forecast period of 2021-2027.

Market Insight

Artificial intelligence plays an

important role in the banking industry as it provides a more secure and faster

work process compared to the human workforce. The AI technology is anticipated

to strengthen the efficiency of the banking sector with improved productivity. In

addition, artificial intelligence include features such as speech recognition,

learning, planning, and problem-solving that enable the banking companies to

deliver secure banking operations that helps to improve the customer experience

and satisfaction. On the other side, hesitancy towards the adoption of

artificial intelligence among banking and financial firms is likely to

hamper market growth over the forecast period.

The COVID-19 pandemic caused

disruptions in the economy. Several sectors including manufacturing,

hospitality, and construction decreased or stopped their operations, which

damaged the growth of these industries. The industries started to restructure

their business models during the pandemic, and many financial firms started to

adopt new technologies to recover from the losses caused by the global lockdown

and economic slowdown. Nonetheless, the internet banking field is expected to

witness a moderate impact as customers are inclining more towards online

banking during the pandemic. Moreover, the growing adoption of online banking

services by consumers augmented the growth of AI in banking market during

the pandemic. Many internet banking platforms leverage AI technology to boost

the customer experience and improve the security, and efficiency of the

platforms.

The growing investment in

artificial intelligence across the world is majorly driving global AI in the

banking market. Furthermore, the rising adoption of internet banking platforms

and solutions is propelling the demand for AI in banking. These days, banks are

becoming increasingly automated, self-monitoring, and self-correcting as the

devices are gaining the ability to analyze and communicate with each other and

their human co-workers. However, the dearth of skilled professionals is hampering

the market growth. Although the investments in AI are growing, the shortage of

skills and experience associated with AI solutions is one of the key challenges

faced by the market. Additionally, the integration of automation technologies

to reduce the effects of COVID-19 is creating opportunities for market players.

Nationwide lockdowns, shortage of workforce due to transport restrictions, and

disruption of the supply chain are expected to drive the demand for automation

across the banking sector.

In terms of regions, North America

accounted for the largest share in the global AI in the banking market due to

the continued leadership of the U.S. in AI technology. The national strategy in

the U.S. including American Artificial Intelligence Initiative is anticipated

to keep United States leadership in the field of AI as a top priority. The

banking industry in the U.S. is likely to register a healthy growth rate as

several financial firms are heavily investing in AI technology to adopt a lean

service model, and reduce operational costs. On the other hand, Asia

Pacific's growth in the AI in banking field is expected to be remarkable owing

to China’s adoption of the technology in its industrial and financial

operations. Moreover, the presence of several leading banks and financial firms

in China, Japan, and India such as Industrial and Commercial Bank of China,

Mitsubishi UFJ Financial Group, and State Bank of India will be a key factor

driving the adoption of AI technology in this region.

Segment Covered

The report on global AI in banking market covers segments such as component, technology, enterprise size, and

application. On the basis of component, the sub-markets include solution and

services. On the basis of technology, the sub-markets include machine learning

& deep learning, natural language processing (NLP), computer vision, and

others. On the basis of enterprise size, the sub-markets include large

enterprises and SMEs. On the basis of application, the sub-markets include risk

management compliance & security, customer service, back office/operations,

financial advisory, and others.

Companies Profiled:

The report provides profiles of

the companies in the market such as Active Intelligence Pte Ltd, BigML, Inc.,

Fair Isaac Corporation, Harman International Industries, Inc., RapidMiner,

Inc., Amazon Web Services, Inc., International Business Machines Corporation,

Microsoft Corporation, Intel Corporation, and Alphabet Inc..

Report Highlights:

The report provides deep insights into the demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of AI in banking market. Moreover, the study highlights current market trends and provides forecast from 2021-2027. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.

Please Choose One of them.