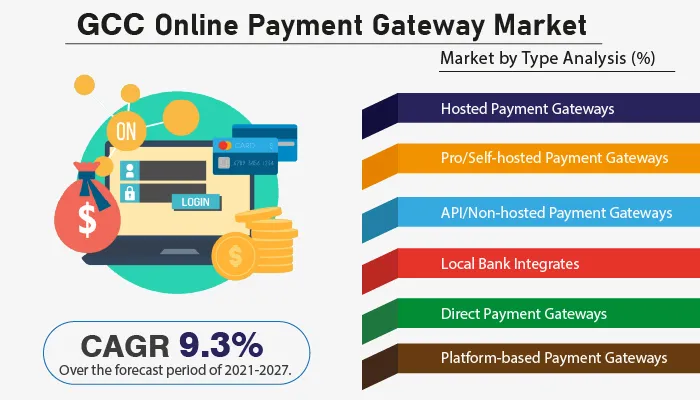

GCC Online Payment Gateway Market (Type - Hosted Payment Gateways, Pro/Self-hosted Payment Gateways, API/Non-hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, and Platform-based Payment Gateways; Application - Micro and Small Enterprise, Large Enterprise, and Mid-sized Enterprise; End-user - Travel, Retail, Banking, and Other End-user Verticals): Industry Analysis, Trends, Size, Share and Forecasts to 2027

A recent report published by Infinium Global Research on online payment gateway market provides in-depth analysis of segments and sub-segments in the GCC as well as regional online payment gateway market. The study also highlights the impact of drivers, restraints, and macro indicators on the GCC and regional online payment gateway market over the short term as well as long term. The report is a comprehensive presentation of trends, forecast and dollar values of GCC online payment gateway market. According to the report, the GCC online payment gateway market is projected to grow at a CAGR of 9.3% over the forecast period of 2021-2027.

Market Insight

Several services went online with the advent of the internet. The internet offers the users accessibility of various services, and convenience to use them. Out of several services, banking services are increasingly becoming online, enabling the customers to remotely access various baking functions. Online payment is one of the banking functions that is been growingly used by customers. The customers use online payment gateways as a platform for various monetary transactions. Moreover, several players in the online payment gateways market work with banks and other companies to offer various exclusive deals to their users. The online payment gateway market in GCC is comparatively younger, and developing at a rapid pace. Many banks are developing their own online payment gateways, at the same time, several online payment start-ups have evolved across GCC. The market is anticipated to grow at a faster rate compared to developed economies.

The Covid-19 pandemic had a severe impact on the economy of the GCC region. Several countries went into strict lockdowns to control the spread of the Covid-19 infection. The financial sector was prominently affected by the pandemic. However, the fintech industry witnessed huge growth over the pandemic. This was mainly due to the lowered use of physical cash, and increased adoption of the internet. Being part of the fintech industry, online payment gateway also grew at a rapid rate over the period of pandemics. Due to the lockdowns across several countries in GCC, people stayed inside their homes and accessed various services through the internet. Moreover, people adopted various contact-less services to reduce the chances of getting infected. This, in turn, augmented the adoption of online payment gateway during the pandemic.

The growing penetration of the internet and smartphones is majorly driving the growth of the online payment gateway market in GCC. A large part of the population in GCC is having access to the internet and smartphones due to their reducing prices. This, in turn, enables them to use various online services such as online payment gateway. Moreover, the e-commerce sector is booming across the GCC region, which is further supporting the market growth. Several e-commerce platforms encourage users to pay online through payment gateways, driving its adoption. However, concerns regarding data privacy are expected to hamper the growth of the online payment gateway market. Nevertheless, several government initiatives to promote digitization of the financial sector are anticipated to boost the online payment gateway market over the forecast period.

In terms of country, the GCC region consists of countries such as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Among these countries, the United Arab Emirates dominated the GCC online payment gateway market. The growing tourism and flourishing retail sector in UAE are supporting the growth of the online payment gateway market. Moreover, the higher penetration of the internet and smartphones is anticipated to boost the online payment gateway market in UAE. Furthermore, the increasing the adoption of 5G technology is likely to augment the growth of the online payment gateway market in the UAE. On the other hand, countries such as Saudi Arabia, Kuwait, and Qatar are expected to grow at a substantial rate over the forecast period. Factors such as growing urbanization, improving lifestyle, and increasing penetration of the internet, and smartphones are anticipated to propel the online payment gateway market in these countries.

Segment Covered

The report on GCC online payment gateway market covers segments such as type, application, and end-user. On the basis of type, the sub-markets include hosted payment gateways, pro/self-hosted payment gateways, API/non-hosted payment gateways, local bank integrates, direct payment gateways, and platform-based payment gateways. On the basis of application, the sub-markets include micro and small enterprise, large enterprise, and mid-sized enterprise. On the basis of end-user, the sub-markets include travel, retail, banking, and other end-user verticals.

Companies Profiled:

The report provides profiles of the companies in the market such as PayPal Holdings, Inc., Alphabet Inc., PayTabs, Telr Dubai, CashU, and RSA Group Dubai, MyFatoorah, Paymentwall Inc., KNET Payment, 2Checkout.com, Inc.

Report Highlights:

The report provides deep insights into the demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of online payment gateway market. Moreover, the study highlights current market trends and provides forecast from 2021-2027. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.