GCC Logistics Market (Mode of Transportation - Railways, Roadways, Waterways, and Airways; End User - Manufacturing, Retail, Aerospace, Government, Banking & Financial Services, and Others): Industry Analysis, Trends, Size, Share and Forecasts to 2027

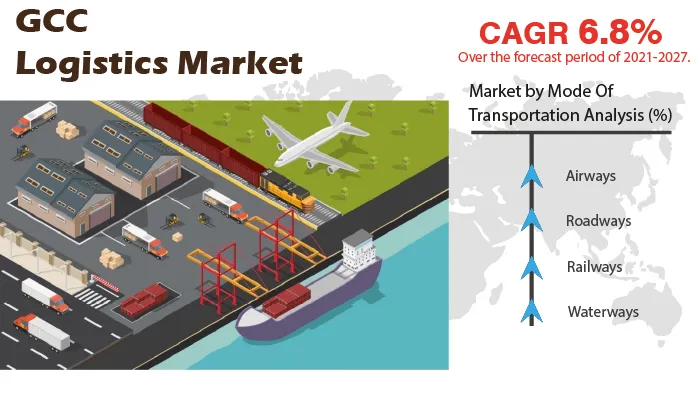

A recent report published by Infinium Global Research on logistics market provides in-depth analysis of segments and sub-segments in the GCC as well as regional logistics market. The study also highlights the impact of drivers, restraints, and macro indicators on the GCC and regional logistics market over the short term as well as long term. The report is a comprehensive presentation of trends, forecast and dollar values of GCC logistics market. According to the report, the GCC logistics market is projected to grow at a CAGR of 6.8% over the forecast period of 2021-2027, growing from more than USD 822 billion in 2020 to about USD 1291 billion in 2027.

Market Insight

The logistics industry in GCC has witnessed several changes over the past few years. Logistic activities such as inventory management, warehousing, packaging, labeling, billing, shipping, and payment collection have transformed as the market players adopt modern technologies. Several companies manage the logistic activities by themselves, while some companies outsource the operations to the logistic service providers. The logistics activities are operated through various modes of transportation including railways, roadways, waterways, airways. Moreover, the players in the GCC logistics market are adopting innovative technologies to offer a better experience to the customers. The logistics service providers such as Agility, Al Madina Logistics, Al-Futtaim Logistics, BAFCO, and Qatar Logistics are some of the leading players in the GCC logistics market.

The COVID-19 outbreak affected the supply chains negatively. The transportation and logistics operations were under heavy pressure during the period of the pandemic. The governments in GCC countries implemented lockdown restrictions over the second and third quarters of 2020. Moreover, the manufacturers were compelled to stop the production of non-essential goods. The companies were allowed to produce and sell only essential goods such as foods, beverages, medicines, medical products, personal care products, and others during the pandemic. The demand for logistics dropped over the pandemic period, as the sale of non-essential products was completely frozen. Furthermore, closed warehouses, restricted transport, and shortage of labor were some of the other problems faced by logistic companies during the pandemic. Nevertheless, as the pandemic situation got under control, the logistics activities were back on track. Furthermore, the demand for logistics from the eCommerce industry increased during the pandemic. Consumers preferred to buy products from online retail channels over the period of pandemics. This trend is expected to continue over the forecast period as well.

The rapidly growing eCommerce sector in GCC is majorly driving the growth of the logistics market in the country. The growing penetration of the internet and increasing use of smartphones boost the adoption of eCommerce in GCC. The growth in the eCommerce sector boosts the demand for logistics services needed for the operations. Moreover, the infrastructure development in the GCC region is further augmenting the growth of the logistics market. The government across GCC are investing heavily in improving infrastructures such as roads, highways, rail tracks, gas stations, charging stations, and others. This supports the expansion of logistic services across the region, including some remote places. However, the lack of reliability on the logistics system poses a major challenge to the market players. Nevertheless, the adoption of advanced technologies such as AI, IoT, and 5G is expected to offer growth opportunities to the market players. The vendors are able to streamline their operations and provide a better experience to the customers by adopting these modern technologies.

In terms of country, UAE accounted for the largest share in the GCC logistics market. Presence of large and developed retail industry in UAE majorly attributes to the domination of the country in the GCC logistics market. The retail industry is the major end-user of logistic services in UAE as well as other GCC countries. The flourishing tourism sector along with better economic conditions drive the retail industry in UAE. Moreover, the UAE logistics market is also driven by the improving infrastructure such as roads, ports, docks, and railways. The government along with other public and private investors are spending heavily on infrastructure development. This, in turn, helps logistics providers to deliver goods quickly and safely.

Segment Covered

The report on GCC logistics market covers segments such as mode of transportation, and end user. On the basis of mode of transportation, the sub-markets include railways, roadways, waterways, and airways. On the basis of end user, the sub-markets include manufacturing, retail, aerospace, government, banking & financial services, and others.

Companies Profiled:

The report provides profiles of the companies in the market such as Agility Public Warehousing Company K.S.C.P., Al Madina Logistics Services Company (SAOC), Al-Futtaim Logistics Company LLC, BAFCO International Shipping & Logistics Co. Ltd., and Qatar Logistics W.L.L..

Report Highlights:

The report provides deep insights into the demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of logistics market. Moreover, the study highlights current market trends and provides forecast from 2021-2027. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.