GCC Cold Chain Logistics Market (Products - Mechanical & Cryogenic Refrigeration Systems, Reefers, Cold Chain Transport Monitoring Equipment, and Packaging Materials; Application - Food & Beverages, Medical Goods, Temperature-sensitive Chemicals, and Others): Industry Analysis, Trends, Size, Share and Forecasts to 2028

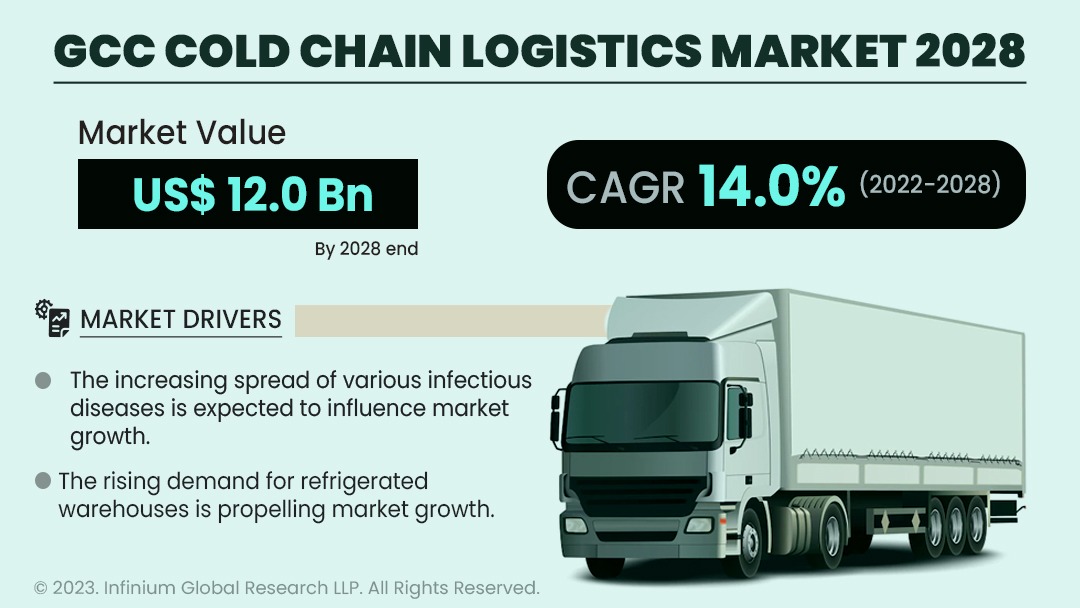

A recent report ongoing study by Infinium Global Research on the cold chain logistics market provides an in-depth analysis of segments and sub-segments in the GCC as well as regional cold chain logistics market. The study also highlights the impact of drivers, restraints, and macro indicators on the GCC and regional cold chain logistics market over the short term as well as long term. The report is a comprehensive presentation of trends, forecasts, and dollar values of the GCC cold chain logistics market. The GCC cold chain logistics market was valued at over USD 5 billion in 2022 and is expected to reach nearly USD 12 billion in 2028, with a CAGR of over 14% during the forecast period.

Market Insight

The increasing dependence of the GCC countries on imports to meet their food requirements has necessitated the development of cold chain facilities. To remain competitive, cold chain operators provide value-added services like labeling, packing, and palletizing in addition to cold storage and transportation. The growth of the dairy industry, expansion of the GCC region's cold chain market, rise in the number of contemporary grocery retail outlets, government measures to lessen reliance on oil exports, and other factors have all contributed to the region's cold chain market's positive growth. Furthermore, the cold chain offers benefits including the ability to optimize inventory accuracy, reduced cycle time, enhanced supply chain efficiency, cost-effective operations, and increased shelf life through the reduction in spoilage and contamination. The benefit offered by the solution has gained traction in supply chain industries and services.

The development of the COVID-19 vaccine at a massive level is expected to be one of the major factors to drive the demand for cold chain logistics in the forecast period. Higher demand for these products is subsequently increasing the demand for their effective transport without losing their freshness and palatability. In the backdrop of the coronavirus pandemic, demand for fresh and frozen products is growing. Cold chain technologies are helping cold chain operators in managing and keep products within a specific temperature range throughout the supply chain as GCC countries impose lockdowns to mitigate the spread of the virus. Cold chain companies all over the GCC region play a very important role in the Covid-19 pandemic. Nevertheless, the stringent regulations regarding the storage and shipment of pharmaceutical products are anticipated to hamper the growth of the cold chain logistics market. Moreover, in recent years, rising consumer demand for perishable goods and the significant growth in the healthcare sector have propelled the demand for temperature-sensitive drugs in GCC countries. This, in turn, is anticipated to create lucrative opportunities for the key players operating in the GCC cold chain logistics market.

With a population that is more than twice that of the other GCC countries, Saudi Arabia is the largest importer of food and agricultural products among the Gulf Cooperation Council (GCC) countries such as the United Arab Emirates, Kuwait, Qatar, Oman, and Bahrain together. The expanding prevalence of health insurance firms and the rising frequency of non-communicable diseases are predicted to significantly increase Saudi Arabia's demand for pharmaceuticals. Additionally, it is anticipated that Saudi Arabia's remarkable gain in per capita income will increase demand for branded pharmaceuticals.. Another key factor driving the growth of the pharmaceutical market in Saudi Arabia is the country's strategic move to allow 100% FDI in the pharmaceutical sector.

Report Scope of the Cold Chain Logistics Market:

| Report Coverage | Details |

|---|---|

| Market Size in 2021 | Over USD 5 Billion |

| Market Size by 2028 | Nearly USD 12 Billion |

| Growth Rate from 2022 to 2028 | CAGR of Over 14% |

| Largest Market | Saudi Arabia |

| No. of Pages | 80 |

| Market Drivers |

|

| Market Segmentation | By Products, and By Application |

| Regional Scope | Saudi Arabia, UAE, Kuwait, and Rest of GCC |

Segment Covered

The report on GCC cold chain logistics market covers segments such as products, and application. On the basis of products, the sub-markets include mechanical & cryogenic refrigeration systems, reefers, cold chain transport monitoring equipment, and packaging materials. On the basis of application, the sub-markets include food & beverages, medical goods, temperature-sensitive chemicals, and others.

Companies Profiled:

The report provides profiles of the companies in the market such as Agility, Wared Logistics, LINEAGE LOGISTICS HOLDING, LLC, Americold Logistics, Inc., Jelaidan Cold Store, DHL, fourwinds-ksa.com, EPICOS, Hala Supply Chain Services Co., and Mosanada Logistics Services.

Report Highlights:

The report provides deep insights into demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of the cold chain logistics market. Moreover, the study highlights current market trends and provides forecasts from 2022-2028. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.