Online Payment Gateway Market (Types - Hosted Payment Gateways, Pro/self-hosted Payment Gateways, API/Non-hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, and Platform-based Payment Gateways; Application - Micro and Small Enterprise, Large Enterprise, and Mid-sized Enterprise; End-users - Travel, Retail, Banking, and Other End-user Verticals): Global Industry Analysis, Trends, Size, Share and Forecasts to 2026

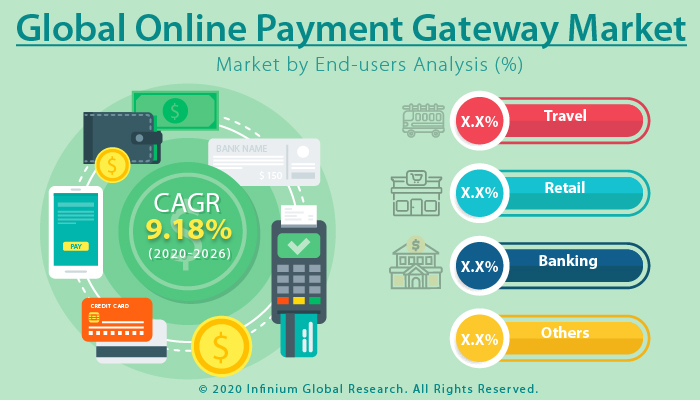

A recent report published by Infinium Global Research on the online payment gateway market provides an in-depth analysis of segments and sub-segments in the global as well as regional online payment gateway market. The study also highlights the impact of drivers, restraints, and macro indicators on the global and regional online payment gateway market over the short term as well as long term. The report is a comprehensive presentation of trends, forecast, and dollar values of the global online payment gateway market. According to the report, the global online payment gateway market is projected to grow at a CAGR of 9.18% over the forecast period of 2020-2026.

Market Insight

The emergence of the internet and information technology (IT) has transformed several industry verticals. One of such transformations is witnessed in the banking sector and particularly in transactions. The evolution of credit and debit cards has established the trend of a cashless economy. Moreover, the growing adoption of the internet across the banking industry has led to the evolution of online banking and fund transfer. On a similar track, several banks and start-ups have developed online payment gateways. A payment gateway is a trusted third-party application that authorizes transactions. The online payment gateways successfully provide end-to-end solutions for a seamless customer experience. They are the key medium to help merchants receive card payments in both situations, i.e., card-present and card non-present transactions. It supports online payment on the Internet or any other electronic channel such as Interactive kiosk, Voice Recognition (IVR), and call center with secure protection and integrity.

The rapidly growing internet penetration across the world is one of the major drivers for the growth of the global online payment gateway market. According to ITU, an estimated 4.1 billion people were using the internet in the year 2019, which was about a 5.3 % rise compared with 2018. As the number of internet users increases, more and more people can transfer funds online. Moreover, the growing demand for a better customer experience is augmenting the growth of the market during the forecast period. Online payment helps the merchant in improving customer experience and increasing merchant revenues. The data generated from the transactions through online payments offers merchants with detailed customer insights, which helps in improving different aspects of business, comprising decisions associated with marketing, promotions, and customer service. However, the lack of global standards for cross-border payments is majorly restraining the global online payment gateway market. Online payment gateway vendors are not able to expand their businesses owing to the dearth of a single universal global payment system, the absence of global standards, and different government regulations. On the other hand, the progressive regulatory reforms in the field of digital payment are anticipated to offer favorable opportunities for the payment gateway market in the future.

The current spread of COVID-19 has turned out to be one of the biggest threats to the global economy and financial markets. With economic growth expected to be severely hit by the pandemic, the online payment gateway sector is also projected to follow a similar trajectory, at least in the short term. But the industry’s stability and potential for innovation will play an invaluable role in restarting the economy to the new normal.

In terms of geography, North America generated the highest revenue in the online payment gateway market. The higher penetration of the internet coupled with a flourishing e-commerce industry in the region is majorly driving the online payment gateway market in North America. With the rising penetration of smartphones and e-commerce in the region, online payment gateways are growing as a potential mode of transaction. Moreover, the ubiquity of credit and debit cards has made them an enabler of digital modes of payment in the U.S. However, Asia Pacific is projected to grow with the fastest CAGR of 12.89% over the forecast period owing to the growth in spending on the internet. In addition, the underlying requirement for secure transactions has increased the demand for online payment gateways in the Asia Pacific region. Increasing penetration of the internet and the growing e-commerce industry in the region are augmenting the growth of the online payment gateway market in the Asia Pacific. China has the largest e-commerce industry in the world, generating about USD 620.5 billion in revenue annually.

Segment Covered

The report on the global online payment gateway market covers segments such as types, application, and end-users. On the basis of types, the sub-markets include hosted payment gateways, pro/self-hosted payment gateways, API/non-hosted payment gateways, local bank integrates direct payment gateways and platform-based payment gateways. On the basis of application, the sub-markets include micro and small enterprise, large enterprise, and mid-sized enterprise. On the basis of end-users, the sub-markets include travel, retail, banking, and other end-user verticals.

Companies Profiled:

The report provides profiles of the companies in the market such as eWAY AU, PesoPay, PayPal, Amazon Payment, Wirecard, Authorize.Net, PayU, MOLPay, Paymill, and Alipay.

Report Highlights:

The report provides deep insights into the demand forecasts, market trends, and micro and macro indicators. In addition, this report provides insights into the factors that are driving and restraining the growth in this market. Moreover, The IGR-Growth Matrix analysis given in the report brings an insight into the investment areas that existing or new market players can consider. The report provides insights into the market using analytical tools such as Porter's five forces analysis and DRO analysis of the online payment gateway market. Moreover, the study highlights current market trends and provides forecast from 2020-2026. We also have highlighted future trends in the market that will affect the demand during the forecast period. Moreover, the competitive analysis given in each regional market brings an insight into the market share of the leading players.

Please Choose One of them.